For Australian corporations, taking care of and lodging Business enterprise Action Statements (BAS) is usually a essential aspect of sustaining compliance with tax legal guidelines. BAS expert services are created to streamline this method, making certain firms meet their obligations towards the Australian Taxation Place of work (ATO) even though reducing problems and not waste time.

What exactly is BAS?

A company Exercise Assertion (BAS) can be a tax reporting doc that organizations use to report and fork out numerous tax liabilities, including:

Goods and Products and services Tax (GST)

Pay out As You Go (PAYG) installments

PAYG withholding tax

Fringe Positive aspects Tax (FBT) installments

Other taxes, in accordance with the business enterprise framework and operations

BAS is Usually lodged regular, quarterly, or every year, with regards to the dimension and kind from your enterprise.

The Position of BAS Solutions

BAS services give Skilled aid in making ready, examining, and lodging Business Activity Statements. These solutions are shipped by registered BAS agents or competent accountants with knowledge in tax compliance.

Core Features of BAS Expert services:

Precise Report Trying to keep: BAS agents make certain all financial transactions are precisely recorded and categorized, forming the foundation for proper BAS calculations.

GST Calculations: They calculate GST on product sales and buys, making sure businesses declare suitable credits and meet their payment obligations.

Compliance Monitoring: BAS brokers keep current on tax legal guidelines and ATO prerequisites, ensuring companies continue to be compliant.

Lodgement Support: Agents get ready and lodge BAS immediately, staying away from late penalties and desire rates.

Error Reduction: Professional writeup on economical data decreases the chance of errors, be a catalyst for high priced audits or penalties.

Advantages of Experienced BAS Providers

1. Time and Anxiety Discounts

BAS planning may very well be time-consuming more info and sophisticated. Outsourcing it'd be to specialists allows business people to concentrate on operations and development.

2. Compliance and Accuracy

Pros make sure that BAS submissions are mistake-free and compliant with ATO laws, giving satisfaction to businesses.

3. Money Move Management

BAS agents deliver insights into tax liabilities and credits, helping corporations control money far better.

four. Danger Mitigation

Skilled dealing with of BAS cuts down on likelihood of audits, penalties, or disputes utilizing the ATO.

Deciding on the Ideal BAS Assistance

Seek out registered BAS brokers with established skills in your market. Ensure they use modern-day accounting software program, are accessible, and even have a robust track record well timed lodgements.

BAS providers are an important useful resource for Australian firms, simplifying tax reporting and fostering monetary compliance and balance. By partnering with gurus, organizations can meet up with their obligations while focusing on attaining result in authentic progress.

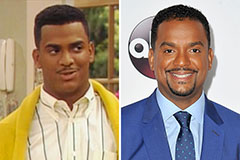

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Brian Bonsall Then & Now!

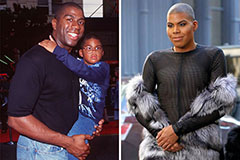

Brian Bonsall Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!